Fiserv

Designing regulatory compliance tools for financial advisors

In 2016, the U.S. Department of Labor (DOL) introduced the Fiduciary Rule, aiming to enhance transparency in the financial advisory industry by requiring advisors to act in their clients' best interests and disclose all fees and conflicts of interest. This regulatory shift necessitated significant changes in how financial institutions reported and communicated information to clients.

As a member of Fiserv's Statement Reporting team, I contributed to developing a comprehensive digital solution to assist financial institutions in complying with these new regulations. Our objective was to create intuitive reporting tools that presented complex financial data clearly and accessibly while adhering to strict regulatory requirements.

Regulatory research & analysis

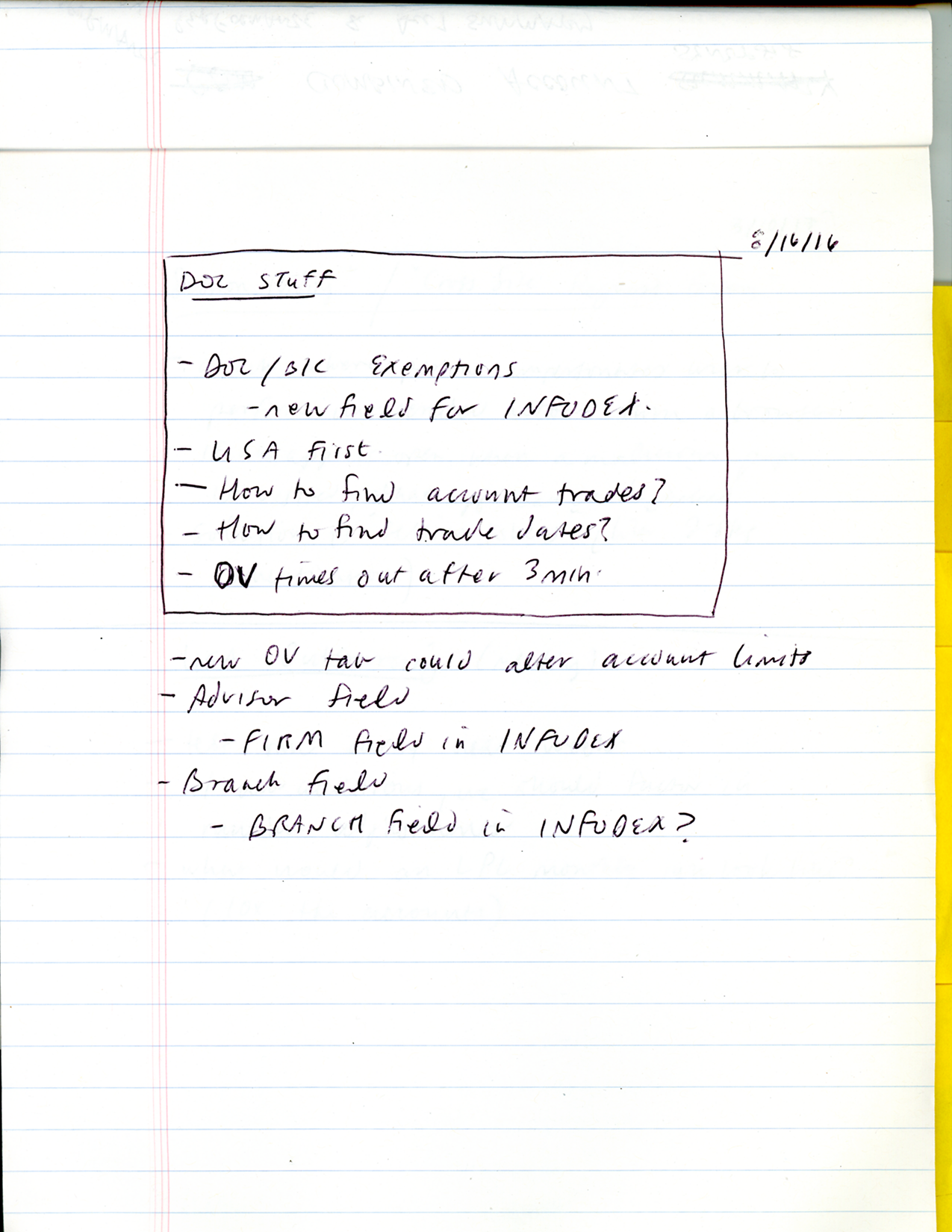

Collaborated with legal and compliance teams to interpret the DOL's Fiduciary Rule, translating complex regulatory requirements into actionable design and functionality specifications. This foundational work ensured our solutions met both legal standards and user needs.

Technical architecture

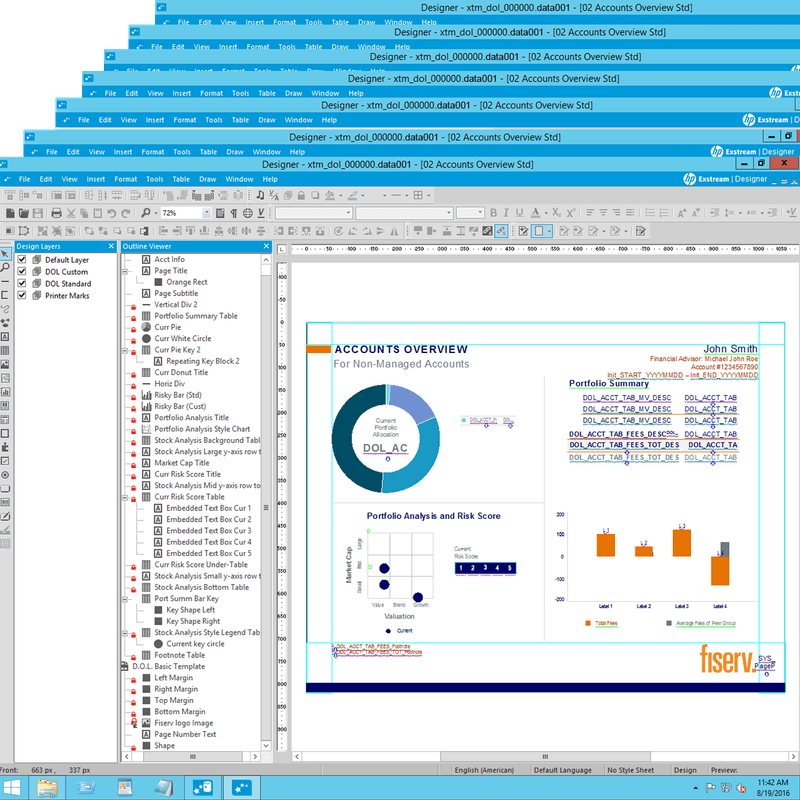

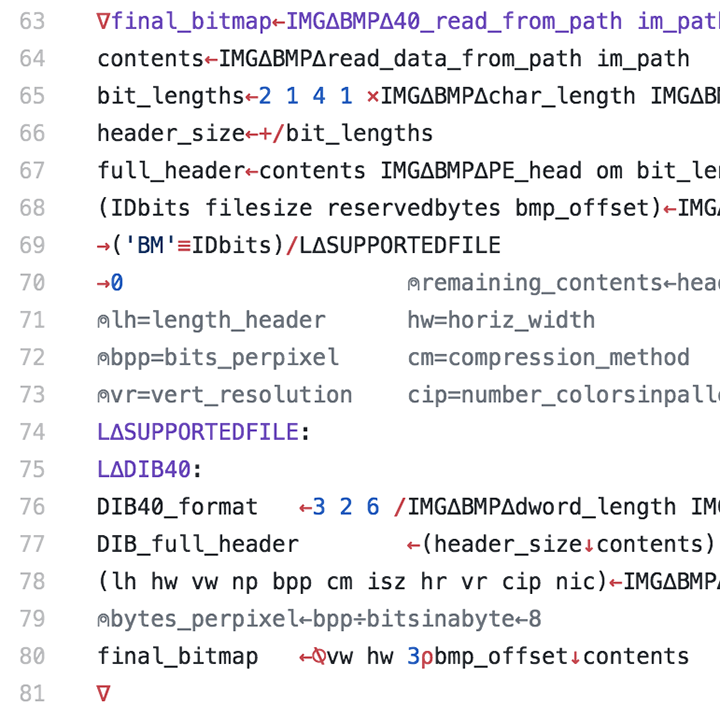

Developed a technical framework utilizing APL (A Programming Language) and PostScript to generate dynamic, personalized reports. The architecture was designed to handle high volumes of data and integrate seamlessly with existing financial advisor workflows.

User experience design

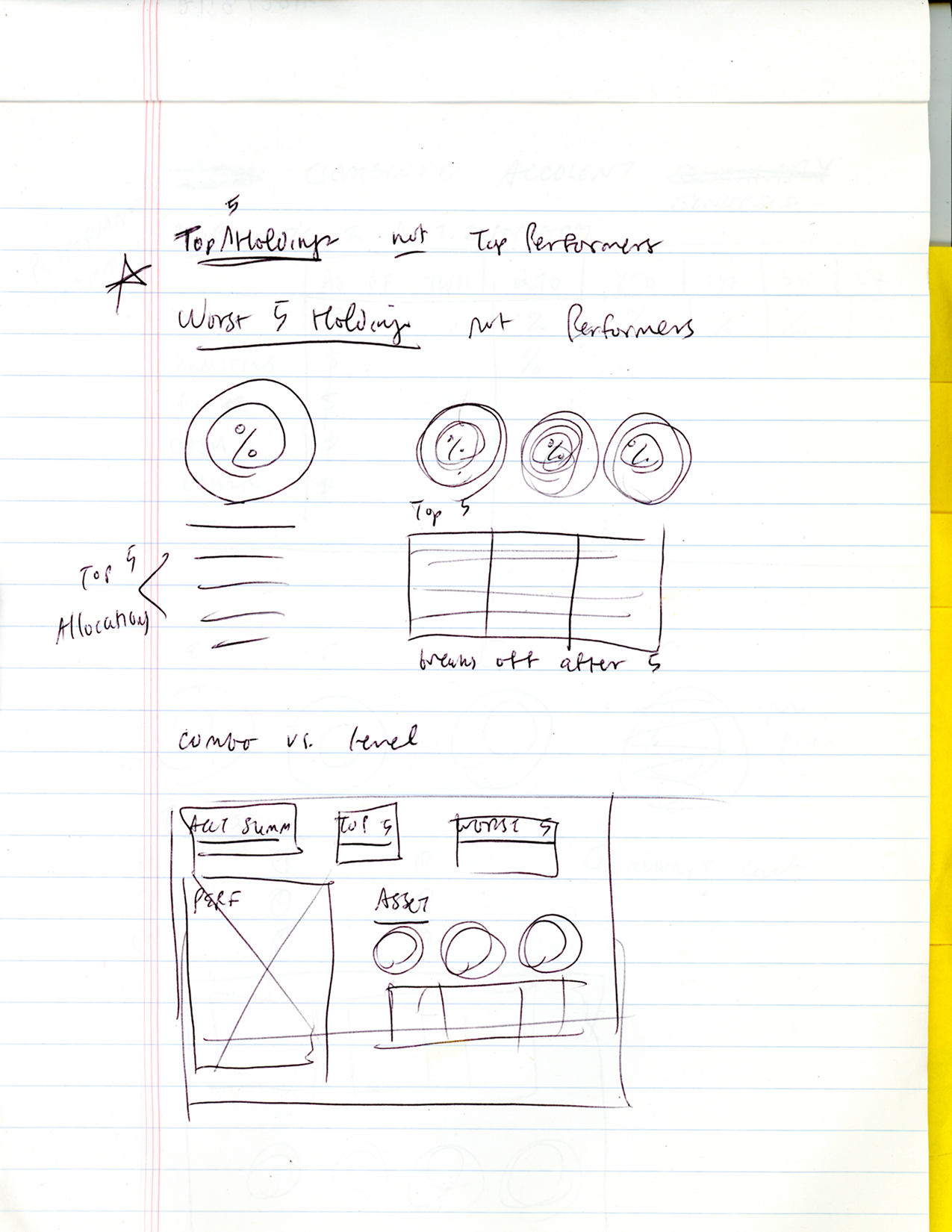

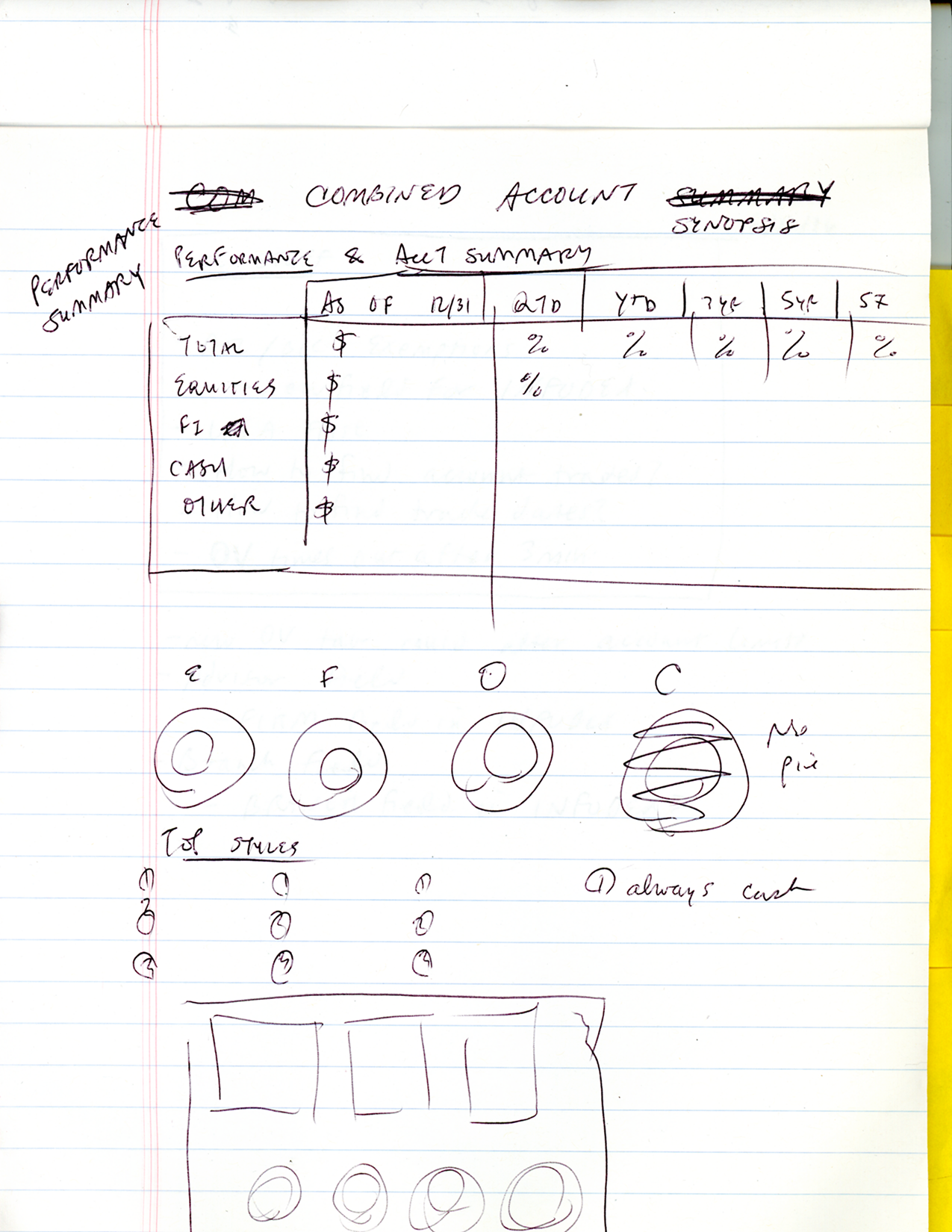

Designed a modular report structure emphasizing clarity and usability. Incorporated plain-language explanations and visual representations of fee structures and investment performance to make complex financial data understandable to clients.

Development & programming

Implemented new functions in APL to extract and process necessary data points from financial systems. Developed templates populated dynamically, ensuring accurate and personalized reporting for each client.

Testing & quality assurance

Conducted rigorous testing across various data conditions and edge cases to ensure reliability and compliance. Performed load testing to verify the system's capability to handle nationwide deployment demands.

Client preparation & sales support

Created sales and marketing materials to aid Fiserv's account teams in preparing financial institution clients for the new regulatory environment. Developed demonstration materials, implementation guides, and training resources to facilitate client onboarding.

Project resolution

After months of development, our solution was ready for deployment. However, following the 2016 election, the incoming administration delayed and eventually nullified the Fiduciary Rule. Despite this, the systems and insights developed were repurposed for other financial transparency initiatives within Fiserv.

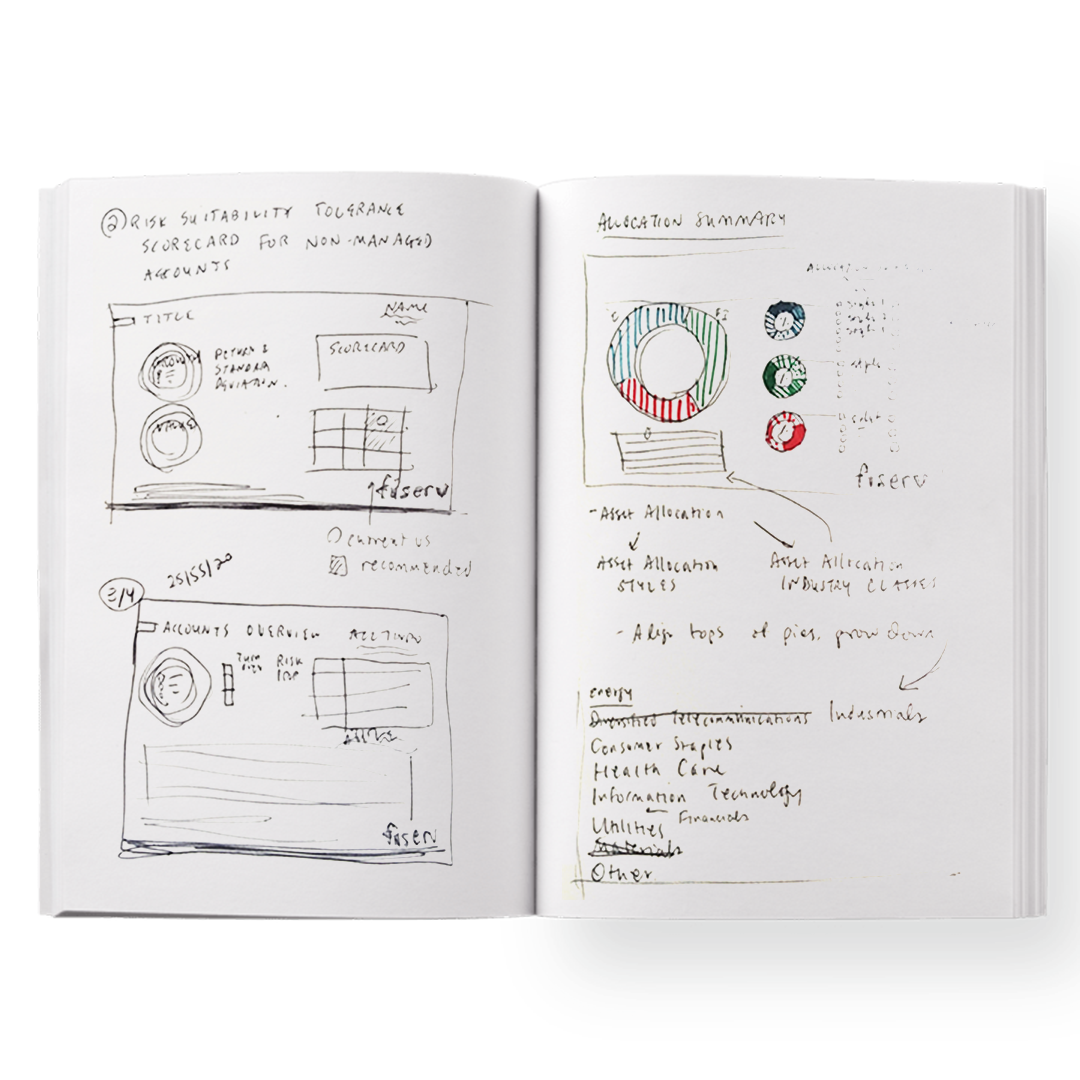

Design process documentation

Maintained comprehensive documentation of the design and development process, including sketches, wireframes, and notes. These assets served as valuable references for future financial reporting projects.

Lessons & impact

This project underscored the challenges of developing solutions in a rapidly changing regulatory environment. While the Fiduciary Rule was ultimately withdrawn, the experience enhanced Fiserv's capabilities in creating transparent financial reporting systems and prepared the company for future regulatory changes in the financial industry.